Actualités économiques

United Nations Economic Commission for Africa - Ideas for a prosperous Africa

-

APRM, ECA, and UNDP Africa welcome credit rating upgrades for African countriespar minilik.demissie le December 7, 2025

6 December, 2025Share this:facebooktwitteremailprintAddis Ababa, 6th December 2025 (APRM, ECA, UNDP-Africa) - The African Peer Review Mechanism (APRM), the United Nations Development Programme (UNDP), and the United Nations Economic Commission for Africa (ECA) have welcomed the recent upgrades in sovereign credit ratings for Ghana, Zambia, and South Africa, along with positive outlook improvements for Nigeria and Uganda by major global ratings agencies, in a joint Press Statement. The three organisations are collaborating on the Africa Credit Ratings Initiative, led by UNDP. This initiative aims to help African countries understand and appreciate credit rating systems and methodologies. It provides technical support, capacity-building, and policy discussions to assist officials in effectively managing credit ratings, thereby fostering greater national ownership of the process used by international agencies such as Moody's, Fitch, and S&P. In November, S&P Global Ratings upgraded Ghana's credit rating from CCC+ to B– due to improved liquidity and reduced risks. Moody's upgraded Ghana's rating from Caa2 to Caa1 in October 2025, and Fitch raised it from Restricted Default to B– in June 2025, both with stable outlooks. These upgrades reflect progress in debt restructuring and fiscal management, particularly a $13.1 billion Eurobond restructuring, indicating increased investor confidence. Similarly, in November, S&P Global Ratings upgraded Zambia's credit rating from Selective Default (SD) to CCC+. This change marks Zambia's official emergence from default after five years, following significant agreements to restructure about 94% of Zambia's $13.3 billion external debt. In the same month, S&P assigned Guinea its first-ever credit rating of B+, further showcasing the growing recognition of Africa's financial development and reform efforts. Additionally, Guinea received its first-ever sovereign credit rating of B+ from S&P in November 2025, highlighting Africa's increasing financial integration and reform progress. South Africa also received a credit rating upgrade in November due to improved fiscal signals and better-than-expected macroeconomic performance. Meanwhile, Nigeria and Uganda experienced positive revisions in their outlooks, reflecting gradual improvements in external liquidity, fiscal consolidation efforts, and constructive engagement with rating agencies. Commenting on recent successes in credit rating trends, Ahunna Eziakonwa, UN Assistant Secretary-General and UNDP Regional Director for Africa, described the Africa Credit Ratings Initiative as a game-changer for African countries aiming to improve their data systems and rating agency capabilities. "With over 260 officials from 18 countries trained, governments are now better equipped to negotiate with rating agencies, potentially shifting Africa's global market narrative," She noted, She observed that “upgrades of Ghana, Zambia, and South Africa demonstrate Africa's increasing creditworthiness and the efforts to strengthen institutions and macroeconomic stability." Jean-Marc Kilolo, the ECA team member on the programme, viewed the credit rating upgrades as a positive sign of progress, enhancing these countries' standings in international financial markets. He stated, “African countries have historically struggled with low ratings due to a lack of accurate data and poor coordination among national institutions. We hope that the initiatives from the three organisations will help overcome these challenges.” The three organisations - APRM, ECA, and UNDP Africa underscore their commitment to supporting member states in strengthening their financial standing to drive economic growth and improve living standards by institutionalising sovereign ratings. Issued on behalf of APRM, ECA and UNDP Africa By Communications Section Economic Commission for Africa PO Box 3001 Addis Ababa Ethiopia Tel: +251 11 551 5826 E-mail: eca-info@un.org

-

Yaoundé Breakthrough: Central Africa builds financial bridge and adopts "common language" to accelerate economic diversification fundingpar eskinder.tsegaye le December 5, 2025

26 November, 2025Share this:facebooktwitteremailprintYaoundé, 26 November 2025 (ECA) — At the Regional Conference on Sustainable Financing Mobilization convened in Yaoundé on 26–27 November, Central African stakeholders took a decisive step toward mobilizing sustainable financing by adopting a common language and a shared methodology to accelerate the region’s economic transformation. They agreed to approach development finance not as isolated initiatives, but as a structured, coordinated and jointly owned process. Organized by the UN Economic Commission for Africa (ECA), in partnership with Member States, CEMAC, and international financial institutions—including the World Bank, the African Development Bank and BDEAC— the Conference gathered government representatives, technical experts, the private sector, UN agencies and development partners. The opening day, dedicated to capacity development, highlighted the core challenge: Central Africa’s bottleneck is not the lack of financing opportunities, but the insufficient structuring of projects. The discussions underscored that financing is constrained not by the availability of funds, but by the region’s limited mastery of the technical and methodological standards required by financiers. This structural gap continues to slow down the mobilization of sustainable financing for infrastructure, industrialization and the green/blue transition. In his opening statement, the representative of the Minister of Economy, Planning and Regional Development of Cameroon stressed the importance of the initiative, noting: “This gathering aims to identify sustainable financing mechanisms for regional bankable projects and to shape multi-stakeholder alliances that can accelerate Central Africa’s economic transformation.” Structuring, Aligning, Accelerating The key takeaway from the capacity-building sessions was unequivocal: financing for structural transformation must be structured. Participants—from government institutions, regional economic communities, UN agencies and international financial institutions—recognized that project development requires professional engineering, methodological rigor, and strong internal systems. This includes: clear logical frameworks and objectives, demonstration of expected impacts, alignment with national strategies, robust risk assessments, environmental and social compliance, solid economic and climate justifications. These elements determine a project’s bankability and competitiveness. Through technical sessions, participants deepened their understanding of both the bankability criteria set by financiers (World Bank, AfDB, Afreximbank, EU, Congo Basin Blue Fund) and the financial instruments available, including guarantees, blended finance and green/blue financing. Member States also reaffirmed the need to institutionalize project-structuring capacities across national systems. As noted by Soumaya Iraqui, Chief of the Economic Diversification Section at ECA’s Subregional Office for Central Africa: “Better structured projects are better positioned—and tomorrow, better financed.” She emphasized the need for permanent institutional support and peer-learning systems to improve project quality and consistency. Participants also highlighted the urgency for countries to diversify their financing sources, crowd in private capital, and align national priorities with sustainable financial instruments. This is essential for strengthening financial resilience, reducing exposure to external shocks and securing long-term financing for the productive sector. Reinventing Development Finance Reaffirming ECA’s leadership role in advancing structural transformation, Jean Luc Mastaki, Director of the ECA Subregional Office for Central Africa, stated: “The Yaoundé meeting is the first concrete regional translation of the commitments made at the Seville Summit. Today, we built methodological bridges between project owners and financiers. Our collective responsibility is to turn Congo Basin resources into engines of industrialization and jobs.” This commitment signals a shift toward a new financing paradigm—one focused not only on mobilizing resources, but on strengthening the region’s capacity to produce credible, technically sound and standards-aligned projects. The High-Level Regional Political Dialogue held on 27 November capitalized on the technical gains of the previous day to produce concrete policy commitments. In a context of declining official development assistance, ECA is emerging as a key convener to unlock Central Africa’s financing potential. The conclusions underline a central message: the region’s future financial competitiveness will depend less on access to existing funding windows, and more on its collective ability to demonstrate quality, coherence and credibility in its projects. Economic transformation will therefore depend as much on mastering global standards as on maintaining strategic vision. Media QueriesZacharie Roger MBARGA - Communications OfficerUnited Nations Economic Commission for Africa637, rue 3.069, Quartier du Lac, Yaoundé, CameroonTel: (+237) 222504348E-mail: zacharie.mbargayene@un.org Issued by:Communications SectionEconomic Commission for AfricaPO Box 3001Addis AbabaEthiopiaTel: +251 11 551 5826E-mail: eca-info@un.org

-

African Group convenes in Chavannes-de-Bogis to advance a strong, development-centered agenda for WTO MC14par minilik.demissie le December 4, 2025

3 December, 2025Share this:facebooktwitteremailprintChavannes-de-Bogis, 3 December 2025 (ECA) – The African Union (AU) Mission and African Group in Geneva convened a high-level preparatory workshop today at the World Trade Organization (WTO), ahead of the 14th Ministerial Conference (MC14) of the World Trade Organization (WTO), to be held in Yaoundé, Cameroon, from 26 to 29 March 2026. The workshop brought together African Ambassadors, trade negotiators and senior officials to assess the state of WTO negotiations and to align positions on Africa’s key priorities for MC14. Opening remarks were delivered by representatives of the AU Mission in Geneva, the African Group in Geneva, the WTO Secretariat, the AU Commission, and the ECA, underscoring the importance of unity, strategic coordination and evidence-based engagement in shaping outcomes at MC14. Addressing participants, ECA emphasized the growing challenges facing the multilateral trading system, amid global geopolitical and economic shocks, and reaffirmed Africa’s long-standing call for a fair, inclusive and development-oriented global trading order. ECA highlighted the African Continental Free Trade Area (AfCFTA) as a central pillar of Africa’s strategy to deepen regional integration, expand intra-African trade, strengthen industrialization and enhance the continent’s collective bargaining power at the WTO. The African Union Commission stressed that Africa must move from being a rule-taker to a rule-shaper in the global trading system. Key priorities highlighted for MC14 include agriculture—particularly a permanent solution on public stockholding for food security, a Special Safeguard Mechanism for developing countries, and disciplines on trade-distorting domestic support—alongside special and differential treatment, WTO reform, dispute settlement, and development-oriented digital trade rules. Discussions throughout the day focused on the current state of WTO negotiations as well as on Africa’s expectations for concrete outcomes at MC14. ECA reaffirmed its commitment to continue providing data-driven analysis and technical support to the AU Mission and African Group in Geneva in the lead-up to MC14 and beyond, in close collaboration with the AUC and the AfCFTA Secretariat, to ensure that Africa speaks with one voice and secures outcomes aligned with its long-term development aspirations and Agenda 2063. Issued by: Communications Section Economic Commission for Africa PO Box 3001 Addis Ababa Ethiopia Tel: +251 11 551 5826 E-mail: eca-info@un.org

-

African island states advance regional co-investment platform at COP30par sid.editor le December 3, 2025

2 December, 2025Share this:facebooktwitteremailprint19 November 2025, Belém, Brazil: Leaders from African Island States called for the fast-tracked operationalization of the AISCC Regional Co-Investment Platform for Climate Finance and the Blue Economy as a key mechanism to scale climate finance, strengthen ocean governance, and foster regional collaboration, during the UNFCCC COP30 High-Level Dialogue on “Charting a Resilient Future for African Island States and SIDS: Accelerating Climate Finance and the Blue Economy.” Jointly organized by the Governments of Seychelles and Guinea-Bissau, the African Island States Climate Commission (AISCC), and ECA, the event marked a significant step toward implementing the Guinea-Bissau Pathway, advancing the RESIslands Initiative, and operationalizing the Regional Co-Investment Platform. The Platform is designed to mobilize predictable, programmatic finance and strengthen multi-country climate and blue economy projects. The Dialogue highlighted the growing role of African Island States within the global climate agenda at COP30. It brought together ministers, ambassadors, and heads of delegations from Small Island Developing States (SIDS), along with climate fund heads, UN agencies, and development partners. The United Nations Secretary-General’s Special Envoy for the Ocean, ambassador Peter Thomson, delivered the keynote opening remarks, highlighting the strategic leadership of island nations at the intersection of the climate and ocean crises. He emphasized global responsibility, declaring, “African Island States and SIDS sit on the frontline of the climate and ocean crises, but they are also sources of solutions—stewards of vital marine ecosystems and champions of the blue economy.” He called for predictable and scaled financing to match the ambition and urgency demonstrated by island governments in implementing resilience and ocean sustainability commitments. Welcoming remarks were delivered by the Director of the Climate, Food Security and Natural Resources Division at ECA, Cosmas Ochieng, who recognized the leadership of the AISCC and the strong commitment of African Island States. He underscored the collective responsibility of the region and its partners, stating, “This dialogue is an opportunity to collectively address SIDS challenges, share solutions, and accelerate the actions needed to safeguard your communities and economies.” Ochieng reaffirmed ECA’s commitment to supporting island states through the RESIslands Initiative, which strengthens institutional capacity, resilience planning, early warning systems, and regional coordination. James Kinyangi of the African Development Bank and Samuel Ogallah of the African Union Commission also reflected on the region’s shared climate pressures and the importance of strengthened institutions to access and deploy climate finance effectively. Member States shared perspectives on the region’s vulnerabilities and determination. Representing the Union of Comoros, the Deputy Director for Environment spoke on behalf of the Minister of Environment and Tourism, Aboubacar Ben Mahamoud, noting that “climate resilience is no longer an option; it is a collective responsibility and a survival imperative.” His remarks urged multilateral funds to simplify access procedures and support the Platform so that island states can act at the speed the crisis demands. In the message from the Minister of Environment and Sustainable Development of Madagascar, Michaël R. Manesimana, it was emphasized that Madagascar’s rich ecosystems remain under severe climate stress, highlighting a need for sustained, coordinated investment. The message noted that “as the impacts of climate change intensify, this Co-Investment Platform represents a strategic opportunity to accelerate bankable blue economy projects and strengthen regional cooperation.” The Ambassador and Permanent Representative of Cabo Verde to the United Nations, Tania Romualdo, reflected on recent extreme weather events affecting her country and called for collective solutions beyond national borders, including the Regional Co-Investment Platform. “What small island states are facing is not an abstract projection but the frontline of the climate crisis,” she emphasized, adding that “the operationalization of the AISCC Regional Co-Investment Platform is an important step toward correcting structural imbalances in access to climate finance and enabling programmatic, multi-country solutions tailored to the realities of island states.” Maria Antonieta Alves Lopes, Ambassador and Permanent Representative of Guinea-Bissau to the African Union, highlighted the country’s growing exposure to coastal erosion, rising seas, and saltwater intrusion. She welcomed the momentum generated by the RESIslands Initiative and affirmed that “its integrated approach—combining institutional capacity building, risk management tools, knowledge exchange and concept notes development—responds directly to our national priorities.” She confirmed Guinea-Bissau’s full commitment to advancing the Co-Investment Platform. Speaking on behalf of Equatorial Guinea, the UNFCCC National Focal Point, Pedro Malavo, emphasized the urgency of global recognition for the country’s island status. He stated, “Equatorial Guinea seeks to be formally recognized as a Small Island Developing State,” noting that such recognition is essential for accessing climate finance aligned with its unique vulnerabilities. He also expressed his country’s support for the Regional Co-Investment Platform for African Island States. The partner reflections segment brought together key SIDS climate partners, including Mathilde Bord-Laurans of the Fund for Responding to Loss and Damage, Catherine Koffman of the Green Climate Fund, Rawleston Moore of the Global Environment Facility, Neha Sharma of the Adaptation Fund, Chitembo Kawimbe Chunga of the Climate Investment Funds, and Tim Hemmings, the United Kingdom Special Envoy for SIDS. They reaffirmed their commitment to supporting African Island States through greater flexibility, streamlined access to funding, enhanced readiness support, and alignment with island priorities, emphasizing that resilience, adaptation, and blue economy financing must be scaled rapidly to meet the urgency of the moment. Closing the event, the Director General for Environment of Seychelles Justin Proper, on behalf of Chair of the AISCC, underscored the significance of coordinated island leadership, asserting that African Island States “have a clear roadmap for resilience and a united voice at COP30.” He highlighted the ongoing importance of implementing the Guinea-Bissau Pathway and the RESIslands Initiative, as well as the transformative potential of the AISCC Regional Co-Investment Platform for long-term action. The High-Level Dialogue demonstrated strong support for the AISCC Regional Co-Investment Platform, which is designed to support national and regional institutions in accessing and managing climate finance, consolidating co-financing mechanisms, strengthening project pipeline development, expanding partnerships, and mobilizing investment for adaptation, resilience, and sustainable ocean-based economies. The Dialogue also called for renewed commitment to coordinated climate diplomacy, enhanced access to finance, and strengthened blue economy development across the region. The AISCC, established by the African Union and chaired by Seychelles with Guinea-Bissau as vice-chair, is recognized as a critical continental mechanism for ensuring that African Island States articulate a unified voice within global climate and development agendas. Through its coordination role, the Commission has become a principal entry point for island-specific resilience strategies and blue economy partnerships. The AISCC Regional Co-Investment Platform is expected to serve as a transformative financing mechanism, enabling African Island States to move from project-by-project engagement to structured, long-term investment strategies. Issued by:Communications SectionEconomic Commission for AfricaPO Box 3001Addis AbabaEthiopiaTel: +251 11 551 5826E-mail: eca-info@un.org

-

Accelerating development: ECA weighs in in debate on new conditions to escape the middle-income trappar eskinder.tsegaye le December 2, 2025

21 November, 2025Share this:facebooktwitteremailprintRabat, 21 November 2025 (ECA) –The ECA Office for North Africa held on Thursday 20 November a webinar under the theme: “Middle income countries trap: the case of North Africa.” The meeting aimed to shed light on new challenges middle-income countries are currently facing, with the aim of helping define an updated analytical framework tailored to their needs. Discussions drew on the experiences of Algeria, Egypt, and Morocco, three of the five largest economies in Africa. “The global context in which middle-income countries (MICs) must operate today is very different of countries that have achieved high income status,” explained Adam El Hiraika, Director of the ECA Office for North Africa. “Economic development and transformation are presently taking place in a context characterized by technological upheaval, geopolitical and economic fragmentation, an aging global population, and, above all, climate change, with increasing environmental constraints and a considerable economic impact,” he added. The middle-income trap is currently defined as a situation where a country’s GDP per capita growth slows down persistently, preventing it from achieving high-income status. This situation reflects a decline in productivity gains which had previously allowed the country to escape the poor country status. Until recently, it was believed that countries could escape the middle-income status by pursuing capital accumulation, structural transformation, integration into global value chains, industrial modernization, and the development of human capital skills and innovation. Such strategies enabled 36 middle income countries worldwide to achieve high-income status between 1993 and 2023. However, the context that enabled their emergence coincided with exceptionally favorable circumstances that have become less available nowadays, such as abundant and cheap energy, inexpensive capital fueled by growing global savings, geopolitical stability, rapid population growth, and the expansion of international trade and global value chains, which, in turn, stimulated technological diffusion. Presently, middle-income countries must increase their productivity while facing climate risks that threaten their economies, growth and living conditions. Their water, energy, and food sectors are under increasing pressure, their infrastructures are vulnerable to climate shocks, and building resilient infrastructures will require significant additional investment, thus leaving middle income countries less equipped than high-income ones for climate adaptation. New pathways out of the middle-income trap currently include investing in sustainable productivity growth through technological modernization, human capital upgrading, and digital transformation; adopting low-carbon and climate-resilient strategies and the sustainable use of natural resources; and equitable and inclusive development by addressing growing income inequality and social exclusion. To escape the middle income trap, countries must also consider increasing their workforces' ability to manage disruptions and strengthen resilience (AI skills, resource management, climate services, adaptability and resilience to shocks, etc.); improving their national capacity for sovereign innovation (strengthening local capacities for innovation to adapt to geopolitical fragmentation and the potential slowdown in technology dissemination); and strengthening the capacity of institutions to respond to major crises such as COVID-19. Other actions include improving their strategic autonomy and regional or sub-regional integration to make up for the decline in global convergence, said Zoubir Benhamouche, an economist at the ECA Office for North Africa. The webinar on “Middle income countries trap: the case of North Africa” was held in accordance with the recommendations of the High-Level Ministerial Conference on Middle Income Countries jointly held in Rabat on 5-6 February 2024 by the UN Economic Commission for Africa (ECA) and the Kingdom of Morocco, in quality of Chair of the Friends of Middle-Income Countries group. It was also held as part of the ECA Office for North Africa support to its member countries with a focus on facilitating the exchange of successful experiences to facilitate their escape from the middle-income trap. Issued by:Communications SectionEconomic Commission for AfricaPO Box 3001Addis AbabaEthiopiaTel: +251 11 551 5826E-mail: eca-info@un.org

-

ECA and i-Capital Africa strengthen Ethiopia’s capacity on market access and private sector financingpar minilik.demissie le December 1, 2025

27 November, 2025Share this:facebooktwitteremailprintAddis Ababa, 27 November 2025 (ECA) – The Economic Commission for Africa (ECA), through its Finance and Domestic Resource Mobilization Section (FDRMS), in collaboration with i-Capital Africa, convened a full-day training workshop on Market Access, Private Sector Financing, Investment and Partnerships at the UN Conference Centre in Addis Ababa. Bringing together regulators, financial institutions, private-sector leaders, development partners and capital-market actors, the workshop served as an important moment for dialogue on how Ethiopia can accelerate the development of its emerging capital-market ecosystem. The gathering comes at a decisive time, as both the Ethiopian Capital Market Authority (ECMA) and the Ethiopian Securities Exchange (ESX) continue to advance, opening new pathways for investment, private-sector expansion and economic transformation. Opening the session, Hopestone Kayiska Chavula of UNECA’s Macroeconomics and Governance Division emphasized the value of collective learning and coordinated action. He described the workshop as a space for regulators, private-sector leaders and development partners “to exchange ideas, challenge assumptions and shape practical solutions,” while urging participants to engage openly and explore new avenues for collaboration. He reaffirmed ECA’s commitment to supporting its member States, Ethiopia included, in strengthening capital-market development, improving financing frameworks and building resilient investment ecosystems through evidence-based policy advice, capacity development and strategic partnerships. Dr. Gemechu Waktola, Group CEO of the i-Capital Africa Institute, followed by underscoring how far Ethiopia has come in a short time. He reflected on the rapid evolution of the country’s capital-market landscape and noted that this collaboration with UNECA comes at a pivotal moment. Strong dialogue between public institutions, private-sector actors and regulators, he stressed, is essential to building a thriving and credible market ecosystem. Throughout the day, experts from ECA and i-Capital guided participants through a series of interconnected themes central to Ethiopia’s financial transformation. Discussions explored the country’s financial and capital-market architecture, the nature of marketable financial assets and investment flows, and the opportunities presented by blended finance and other innovative financing instruments. Participants also examined risk-sharing tools, guarantees and deal-structuring approaches, alongside practical frameworks for public–private partnerships, pipeline development and investor matchmaking. Case studies, group work and simulations enabled attendees to translate these concepts directly into Ethiopia’s evolving operational context. The training was jointly delivered by experts from UNECA, i-Capital Africa, the Ethiopian Capital Market Authority (ECMA), as well as key market-development partners TCX and Frontclear. Their contributions enriched the discussions with practical perspectives on de-risking instruments, FX-hedging solutions, guarantees and the broader mechanics of private-sector financing. This collaboration reflects UNECA’s ongoing support to ECMA in mobilizing anchor and institutional investors for thematic bond issuances, including the forthcoming maiden Gender Bond, while also strengthening national capacity for capital-market development. The workshop closed with a shared recognition of both the progress made and the work ahead. Participants underscored the importance of strengthening institutional capacity to support Ethiopia’s capital-market development and highlighted the need for deeper collaboration between regulators, development finance institutions and the private sector. ECA reaffirmed its continued commitment to supporting Ethiopia in building strong financial markets, fostering an enabling environment for investment and advancing structural transformation through evidence-based policy support. Issued by: Communications Section Economic Commission for Africa PO Box 3001 Addis Ababa Ethiopia Tel: +251 11 551 5826 E-mail: eca-info@un.org

Financial Afrik Toute la Finance Africaine

-

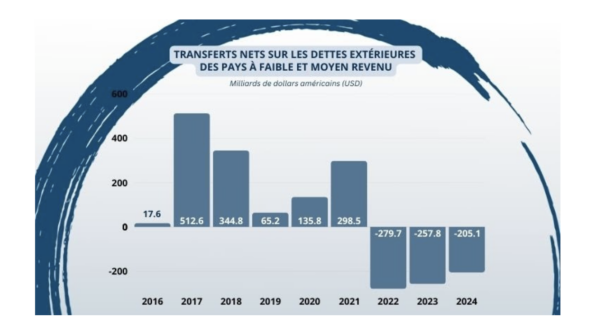

Un record depuis 50 ans : les pays pauvres ont remboursé 741 milliards de dollars de dettes en deux ans (Banque Mondiale)par Rédaction le December 7, 2025

Ce contenu est réservé aux membres. Visitez le site et connectez-vous ou bien adhérez pour le lire. Lire la suite»

-

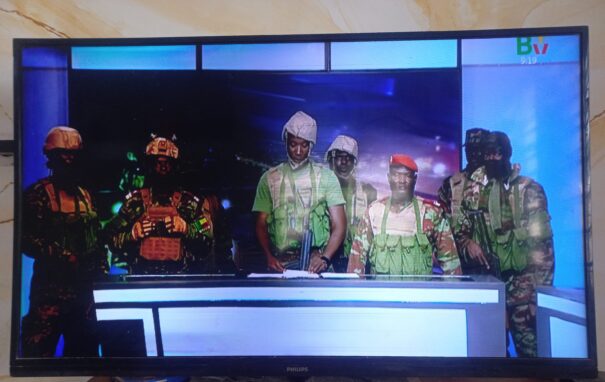

Bénin : tentative de coup d’État déjouée dimanche 7 décembre. Mise à jour en continupar Rédaction le December 7, 2025

Des militaires ont annoncé, ce dimanche 7 décembre, avoir démis Patrice Talon de ses fonctions de président de la République du Bénin. Dans une déclaration lue sur la télévision nationale à l’aube, ils invoquent une série de griefs : « dégradation de la situation sécuritaire au nord du pays », « attribution des marchés publics sans transparence », « vote de lois crisogènes », « exclusion totale d’acteurs politiques aux idées jugées contraires à la gouvernance de M. Lire la suite»

-

Situation confuse au Bénin : tentative de coup d’Etatpar Rédaction Financial Afrik le December 7, 2025

Des militaires ont annoncé, ce dimanche 7 décembre, avoir démis Patrice Talon de ses fonctions de président de la République. Ils citent, comme motifs, la « dégradation de la situation sécuritaire au nord du pays », l’« attribution des marchés publiques sans transparence », le « vote des lois crisogènes », l’ « exclusion totale de acteurs (politique) ayant des idées jugées contraires à la gouvernance de Monsieur Patrice Talon », et la dégradation des conditions de vie des militaires et des enseignants, entre autres. Lire la suite»

-

Souveraineté économique du Sénégal : le système bancaire comme levier de sortie de crise et de relancepar Contribution le December 6, 2025

Par Thierno Seydou Nourou SY, Banquier, Fondateur de Nourou Financial Consulting (NFC) Dakar- Sénégal. Le Sénégal traverse une période économique complexe, caractérisée par un endettement public élevé (près de 110% du PIB) des déficits jumeaux persistants (Déficit budgétaire prévu en 2025 à 7,1% du PIB et déficit du compte courant entre 12% et 14% en 2025) et une confiance érodée des partenaires. Pourtant, paradoxalement, le pays dispose d’atouts considérables : ressources naturelles (pétrole, gaz, minéraux), une démographie jeune, une diaspora dynamique et des plans de vision ambitieux (SND 2025-2029, Vision 2050). Lire la suite»

-

RDC : de nouvelles conditions pour les exportateurs de cobaltpar Félix NZALÉ le December 6, 2025

Ce contenu est réservé aux membres. Visitez le site et connectez-vous ou bien adhérez pour le lire. Lire la suite»

-

Cameroun : l’orpaillage provoque une crise climatique à l’Est du payspar Bernard Bangda le December 6, 2025

Ce contenu est réservé aux membres. Visitez le site et connectez-vous ou bien adhérez pour le lire. Lire la suite»

Commentaires pour Financial Afrik Toute la Finance Africaine

-

Commentaires sur Guinée : la Lonagui retire à « Guinée Games » sa licence d’exploitation par truecaller modpar truecaller mod le December 4, 2025

C'est vraiment intéressant de voir comment la situation évolue avec "Guinée Games". La décision de la Lonagui pourrait avoir des implications significatives pour l'industrie du jeu en Guinée. J'espère que cela va mener à une meilleure régulation et des opportunités pour de nouvelles entreprises. Quelles en seront les conséquences pour les joueurs et les employés de "Guinée Games"?

-

Commentaires sur Lancement au Maroc du nouveau HUAWEI Y9 Prime 2019 par JKT JKTpar JKT JKT le November 13, 2025

Le HUAWEI Y9 Prime 2019 semble vraiment prometteur ! J'adore l'idée du système de caméra pop-up et les fonctionnalités qu'il offre à ce prix. Hâte de voir comment il se compare aux autres smartphones sur le marché marocain !

-

Commentaires sur Lettre ouverte à Assimi Goïta, Président de la Transition de la République du Mali par Abdoulaye Amadou Maigapar Abdoulaye Amadou Maiga le November 11, 2025

Je vote et je suis convaincu que si ce qui est étalé dans le document se traduit en acte notre pays sortira grand

-

Commentaires sur Non, le Mali ne doit pas tomber par CI-Belle vue Naturepar CI-Belle vue Nature le November 11, 2025

Quand on veut aider une population avec des intentions franches il y a des termes qu'on n'emploie pas pour créer une atmosphère conviviale. Peu importe le dirigeant, on peut envoyer son aide en montrant nos bonnes intentions. C'est pays bien que gérés par des militaires sont l'aspiration de leur peuple. Dans un souci de soutien, la Côte d'Ivoire doit être écarté dans l'approche car son dirigeant n'est pas l'exemple d'un dirigeant démocrate. On peut trouver dans la sous région des dirigeants d'une bonne moralité et apprécier de leur population pour créer le canal de discussion pour des solutions de paix.

-

Commentaires sur RDC : les entrepreneurs appellent à la suppression des taxes et entraves à la relance de l’agriculture par Dkwinpar Dkwin le November 9, 2025

C'est encourageant de voir les entrepreneurs s'unir pour appeler à des changements positifs dans le secteur agricole. La suppression des taxes et des entraves pourrait véritablement booster la relance de l'agriculture en RDC. Espérons que ces demandes soient entendues et mises en œuvre rapidement pour favoriser la croissance et la durabilité du secteur.

-

Commentaires sur Marie Odile Sène, Directrice Générale de CGF Bourse : « le départ brusque de Gabriel Fal a été un vrai choc émotionnel pour toute l’équipe » par hiwinpar hiwin le November 6, 2025

Merci pour cet article éclairant. Le départ de Gabriel Fal doit effectivement être un moment difficile pour l'équipe. J'espère que CGF Bourse trouvera la force de surmonter ce choc et de continuer à avancer.

محتوى جريدة الشروق RSS - مال وأعمال- بوابة الشروق

-

السويدي: الذكاء الاصطناعي لن يؤدي إلى خسارة وظائف القطاع الصناعيpar أعمال le December 7, 2025

قال أحمد السويدي، رئيس مجلس أمناء مؤسسة السويدي، إنه لا يعتقد أن الذكاء الاصطناعي سيتسبب في خسارة الوظائف في القطاع الصناعي.وأضاف السويدي، في تصريحات صحفية، ردًا على تساؤلات "الشروق" حول تأثير الذكاء الاصطناعي في تراجع معدلات التوظيف بالقطاع الصناعي، قائلا: "إن كل تطور تكنولوجي يحدث، يتوقع معه البشر أن يفقدوا وظائفهم، وهذا حدث عندما دخل الكمبيوتر في القطاع الصناعي، لكن مع مرور الأيام يثبت أنه لا غنى عن البشر، لأنهم هم المسؤولون عن تشغيل أي تكنولوجيا حديثة".

-

وزير المالية: ارتفاع الإيرادات الضريبية بـ600 مليار جنيه العام المالي الماضىpar أعمال le December 7, 2025

• رئيس "الجمارك": 5 أيام للإفراج الجمركي في 2025 ونستهدف يومين للأغذية والأدويةعدّ أحمد كجوك وزير المالية، زيادة الاستثمارات الخاصة بنحو ٧٣٪، بأنها تعكس تحسن الاقتصاد، وقال: «ما حدش بيجامل بفلوسه»، مشيرا إلى أن هذا الارتفاع يمثل بداية قوية لاستعادة ثقة وشراكة القطاع الخاص، وتحفيزه على قيادة النمو الاقتصادي، وذلك في حوار مفتوح مع طلاب جامعة النيل، وفق بيان اليوم.

-

هبوط القمح وصعود الذرة.. إعادة ترتيب خريطة الاستيراد المصرية وفقا للأسعار العالميةpar أعمال le December 7, 2025

ارتفعت واردات مصر من الذرة الصفراء بنسبة 27.5% خلال الفترة من يناير وحتى نوفمبر الماضي، إذ قفزت الكميات المستوردة هذا العام إلى 10.2 مليون طن، مقابل 8 ملايين طن خلال الفترة نفسها من العام الماضي، وفقاً لوثيقة رسمية حصلت «الشروق» على نسخة منها.وبينت الوثيقة أن واردات الذرة الصفراء، التي تُعد المكون الأساسي في صناعة الأعلاف بمصر، بلغت 932 ألف طن شهرياً في 2025، مقارنة بـ733 ألف طن شهرياً العام الماضي.

-

توقيع بروتوكول تعاون بين هيئة المواد النووية والهيئة العامة للبترولpar أعمال le December 7, 2025

• عصمت: استمرار العمل على تعظيم العوائد من الخامات الارضية.. وبدوى: إعادة التعامل الآمن مع المخلفات لتعظيم الاستفادةشهد وزيرا الكهرباء، محمود عصمت، والبترول، كريم بدوي، توقيع بروتوكول تعاون بين هيئة المواد النووية والهيئة العامة للبترول، بشأن معالجة مخلفات الأعمال البترولية الناتجة عن أنشطة شركات قطاع البترول، وبما يضمن الحفاظ على السلامة البيئية والصحية وفقاً للمعايير الوطنية والدولية.

-

القابضة للمياه تبحث التعاون مع نوادي الروتاري لمد الوصلات المنزلية للفئات الأكثر احتياجاpar أعمال le December 7, 2025

بحث المهندس أحمد جابر شحاتة، القائم بأعمال رئيس مجلس إدارة الشركة القابضة لمياه الشرب والصرف الصحي، مع ممثلي نوادي الروتاري آليات تعزيز التعاون المشترك لدعم تنفيذ الوصلات المنزلية للأسر الأكثر احتياجًا في عدد من المحافظات.جاء ذلك خلال اجتماع مع رئيسة لجنة المياه وخدمة المجتمع بروتاري مصر والرئيس السابق للنادي علا النوري، والمهندس أمين صبري، والمهندسة

-

ارتفاع قيمة أرصدة الذهب المدرج باحتياطي النقد الأجنبي لـ17.252 مليار دولار بنهاية نوفمبر الماضيpar أعمال le December 7, 2025

كشف البنك المركزي المصري عن ارتفاع قيمة أرصدة الذهب المدرج باحتياطي النقد الأجنبي إلى 17.252 مليار دولار بنهاية شهر نوفمبر 2025 ، مقابل 16.545 مليار دولار بنهاية أكتوبر السابق عليه ، بزيادة قدرها 798 مليون دولار.وكان المركزي قد أشار إلى ارتفاع احتياطي النقد الأجنبي لديه إلى 50.215 مليار دولار بنهاية شهر نوفمبر 2025 ، مقابل 50.071 مليار دولار بنهاية أكتوبر السابق عليه ، ، بزيادة قدرها 144.4 مليون دولار.

OxAn Feed: Most Recent - An Analysis Feed from Oxford Analytica These items represent those from Oxford Analytica's most recent publication date. If there are fewer than approximately 25, please check back again soon, as we are still publishing for the day. For more information about the Oxford Analytica Daily Brief Services, please see http://oxan.to/dbabout. (Note: Oxford Analytica is not a news provider but is an analysis provider.)

-

Mexico's new attorney general will face bias claimsle December 5, 2025

Mexico has appointed a new attorney general, who is considered particularly close to the president

-

Armenia's Pashinian bets on growth and fiscal prudencele December 5, 2025

Budget hopes to bring peace dividends for Armenia, but progress will be slow to show

-

Italian-Gulf ties will continue deepeningle December 5, 2025

Meloni’s attendance at the Gulf Cooperation Council summit underscores Italy’s deepening engagement with Gulf states

-

Slowing growth may have electoral impact in Brazille December 5, 2025

GDP growth continued to slow in the third quarter, according to newly released data

-

Living cost pressures linger even as food prices fallle December 5, 2025

Global food prices fell for a third month in November as removal of US beef import tariffs helped stabilise meat prices

-

Data questions will remain after US-Kenya health dealle December 5, 2025

Washington and Nairobi have signed the first of a proposed 60 US-sponsored bilateral health pacts

Oxford Business Group Economic Research & Foreign Direct Investment Analysis

-

Forward thinking: Targeting availability and affordability to boost inclusionpar OBG Admin le September 16, 2022

The availability and affordability of financial services such as payments, savings, credit and insurance are central to financial inclusion. Rural populations, women and low-income groups in Côte d’Ivoire have historically had less access to financial services, which has impeded growth and economic activity. The comparatively high cost of traditional banking products has also been a contributor to low uptake. However, the development and increasingly widespread use of mobile money and digital financial services are playing a significant role in the country’s economic performance and catalysing financial inclusion. Mobile Money The number of Ivorians using mobile money services rose from 7.5m in 2016, or 30% of The post Forward thinking: Targeting availability and affordability to boost inclusion appeared first on Oxford Business Group.

-

Outward bound: New opportunities for Ivorian players to expand in UEMOApar OBG Admin le September 16, 2022

Côte d’Ivoire’s importance as a regional centre for the insurance sector is growing, as an increasing number of pan-African players open offices and branches in Abidjan. The country has been a catalyst for the integration of public and private insurance stakeholders in the 14 member countries of the Inter-African Conference on Insurance Markets (Conférence Interafricaine des Marchés d’Assurances, CIMA). Even though large pan-African and international players dominate the insurance sector in Côte d’Ivoire, and in the CIMA region more broadly, Ivorian insurance players have an eye on extending their operations in UEMOA. Regional Leader In terms of total premium for the life and non-life segments, The post Outward bound: New opportunities for Ivorian players to expand in UEMOA appeared first on Oxford Business Group.

-

Fiscal reach: Many authorities are attempting to bridge tax revenue gaps by introducing levies on electronic transactionspar OBG Admin le September 16, 2022

A number of sub-Saharan African countries have sought to introduce taxes on mobile transactions, in response to the sustained uptake prompted by the Covid-19 pandemic. While such moves have been met with criticism, they represent an opportunity to boost tax revenue significantly. The Covid-19 pandemic and its knock-on effects gave rise to a sharp increase in electronic payments across the African continent – a trend that is set to continue. In parallel to this, public finances in the region have taken a significant hit, as The post Fiscal reach: Many authorities are attempting to bridge tax revenue gaps by introducing levies on electronic transactions appeared first on Oxford Business Group.

-

Remunerating progress: Boasting resilience and robust growth, t he Bourse Régionale des Valeurs Mobilières remains a top-performing exchangepar OBG Admin le September 16, 2022

The Bourse Régionale des Valeurs Mobilières (BRVM) of UEMOA, which includes Benin, Burkina Faso, Côte d’Ivoire, Guinea Bissau, Mali, Niger, Senegal and Togo, began its activities in 1998 with 35 listed shares. The exchange has since grown considerably – by the end of 2021 it had 46 securities, 35 of which were issued by Ivorian companies; and 123 bond lines, 94 of which were listed on the bond market and 29 unlisted. The BRVM has been a top-performing African stock exchange since 2015, when it The post Remunerating progress: Boasting resilience and robust growth, t he Bourse Régionale des Valeurs Mobilières remains a top-performing exchange appeared first on Oxford Business Group.

-

Sowing success: Export commodity prices and new company groupings are adding dynamism to the regional agriculture sectorpar OBG Admin le September 16, 2022

In 2021 the global economy was marked by an exacerbation of market supply difficulties, in line with the persistent impact of the Covid-19 pandemic. In this context, crude oil prices on international markets jumped by 49.8% in one year in US dollar terms. Over the same period, agricultural producer prices increased by 17.6% compared to 2020. For the main commodities exported by UEMOA countries, prices also rose over the whole of 2021, by 60.6% for coffee, 41.8% for cotton and 31.6% for rubber. New Groupings The post Sowing success: Export commodity prices and new company groupings are adding dynamism to the regional agriculture sector appeared first on Oxford Business Group.

-

Favourable figures: New maturities on bond issuances debut as the regional debt market remains a key source of financing for UEMOA statespar OBG Admin le September 16, 2022

Economic activity in UEMOA strengthened in 2021, resulting in 6.1% estimated growth in GDP after a sharp slowdown in 2020 due to the effects of the Covid-19 pandemic. Economic stimulus measures implemented by member states and the accommodative monetary policy maintained by the Central Bank of West African States (Banque Centrale des Etats de l’Afrique de l’Ouest, BCEAO) were the primary drivers of this growth. The average annual inflation rate was estimated at 3.6%, compared with 2.1% in 2020, due to the rise in the The post Favourable figures: New maturities on bond issuances debut as the regional debt market remains a key source of financing for UEMOA states appeared first on Oxford Business Group.